PRE-FILE IRS FORM 2290 FOR YEAR 2019-20

Pre-Filing for Tax Form 2290 for the Upcoming Tax Year 2019-2020 begins this Friday June 1st 2019 Exclusively with TruckTaxOnline.com. Do not Wait until the Tax Period begins in July.Pre-filing enables you the power to e-file your annual Heavy Vehicle Use Tax before July 1 when the new tax year officially begins. It helps to avoid rush and last minutes hiccups !

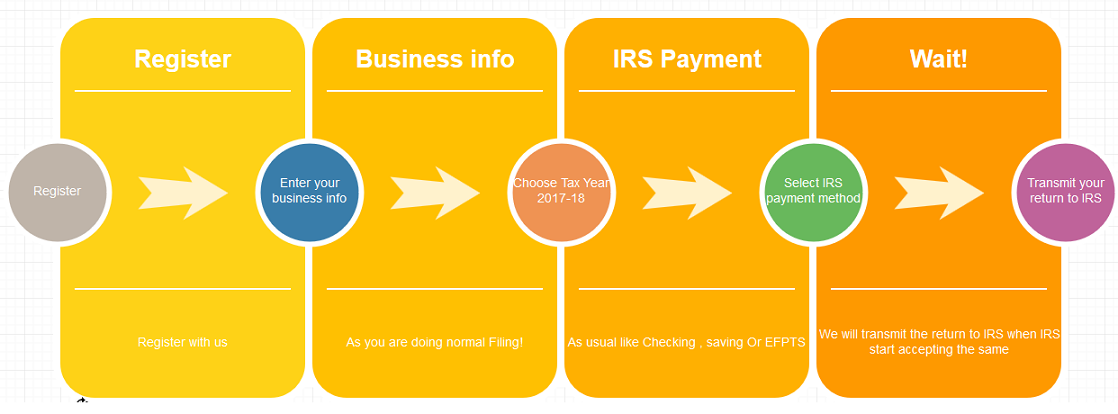

Pre-filing works in the same way E-filing does for the regular tax year. pre-file is to offer you an easy renewal process of your schedule-1 copy for the new tax year since, IRS e-file servers would likely be snail-slow during season time due to the e-file traffic they receive. So the sooner you e-file at TruckTaxOnline.com, the faster you get your Schedule-1 copy stamped! It is true that IRS wouldn’t accept any 2019-20 tax returns until first week of July 2019.

However TruckTaxOnline.com would hold your tax returns filed through us and securely submit them to the IRS the moment they open for 2019-20, and deliver your schedule-1 copy to your e-mail address instantly.

How it works?

Why not think about 2019-2020 tax year? Are you thinking it is too early? No, not at all. In order to stay ahead, it is wise to pre-plan our activities. So why not prepare ourselves for 2019-2020 tax years, as IRS offers you with a pre-filing option for HVUT form 2290?

Why Should I Pre-file My 2290?

- Pre-file now and pay later.

- No rush & plenty of time to correct rejected returns before the deadline.

- Get your Stamped Schedule 1 before everyone else.